WordPress Theme Made

For Freelancers

You can trust us. We will double your hourly rate.

Best Rated Theme of All Time

No.1 out of 9,000+ themes

What can you create with The Ark?

Finally, there is no limit to what you can create, below are just a few examples.

Small business websites

Create stunning websites for your clients or your business

Corporate websites

Produce prestige, clean and good looking website for corporations

Authority Blogs

Grow your audience with our premium blogging system

Ecommerce shops

Create sites which sells goods online

Secure membership portals

Protect your content in secure membership portals

Landing Pages

Create high converting pages

Sales & Marketing pages

Create full scale marketing sites and sales pages

Mobile Ready versions of all pages

All your pages will be mobile automatically

The Ark

Academy

A complete, 8+ hours long, video course. Divided into 117 standalone lessons.

Covers every aspect of working with Ark. Made directly by the Ark team.

Hire Us

Get access to the agency behind Ark Theme and hire WordPress Developer

Website Development

We can create any kind of website, powered with the Ark theme.

Custom CSS, PHP and JS

After 10 years in WordPress development, we can code anything.

Cooperation with Agencies

PSD to WordPress - we are world class players in this discipline

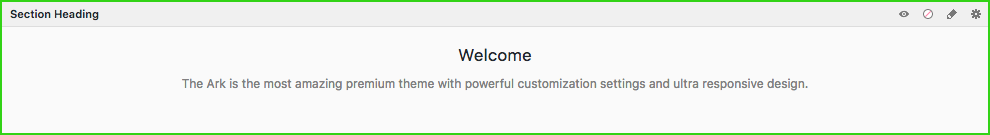

250+ Section Blocks Library

Insert 5 of them and page is finished

Pick few of the 250+ predefined sections, put them together and tadaa, your website is done in literally 2 minutes. Template Section Blocks are build from basic elements, so you still have the full control.

No coding required!

You can change everything without writing a single line of code

In this example we are modifying one of the 220+ builder elements. On average, every element has 1500+ customisable options. Changes are done exclusively using the tools available inside that single element. No coding knowledge required.

Before

After

Success Stories

Denise Marques Leitão

Purchased 2 licenses so far

“Ark is so intuitive! I love it!”

I'm not a super tech-savvy person; I'm a writer! And yet I was able to make a small business website pretty fast. I tried another theme (because I already had a license) for my personal page but I could not use it. It seemed so clunky and hard to use compared to the Ark. Ark is so intuitive! I love it! So I happily bought another Ark license and built my website in 2 days.

Thomas Vychodil

Purchased 8 licenses so far

“2 marketing sites in 1 day.”

In the past, I have usually been using one of the dinosaur themes such as Avada and X. But they really started to show their age since they are from 2013. With Ark I have finally found a perfect and modern WordPress theme. The team behind the Ark has created a multi-use masterpiece. I was able to create 2 marketing sites in 1 day and am genuinely having fun creating my pages now.

Video Testimonials

We have reached out to our amazing Ark community and asked them to record short video testimonials for you. Each person has their own story and reasons for choosing Ark as their preferred tool for making websites on WordPress.

Built by leaders in the WordPress industry

1mil sales

100k users

3 awards

Made for performance

Every aspect of Ark was carefully optimized to produce the fastest website possible. There are a lot of caching and development optimizations under the hood that you will not find anywhere else. Unlike all the other multipurpose themes, Ark is not bloated.

Bootstrap Responsive Grid

Ark contains dedicated Bootstrap elements that you can infinitely nest in Fresh Builder. No other theme will allow you this level of control. You can pull, push, offset, overlap, and more.

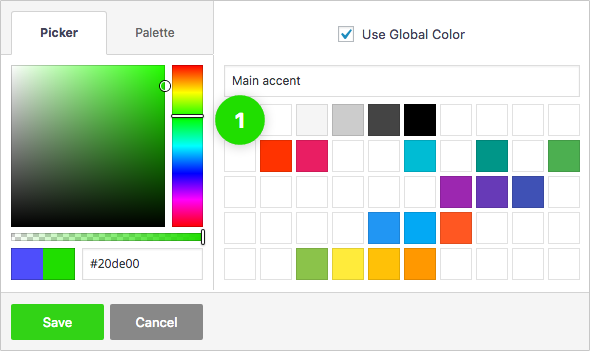

Global Color Library

Each color slot works like a global variable. Change a color in one place and it will change everywhere on your website.

Background Layers Editor

Get creative with unlimited number of background layers, in any order.

1 Image Layer

2 Video Layer

3 Slant Layer

4 Parallax Layer

5 Color Layer

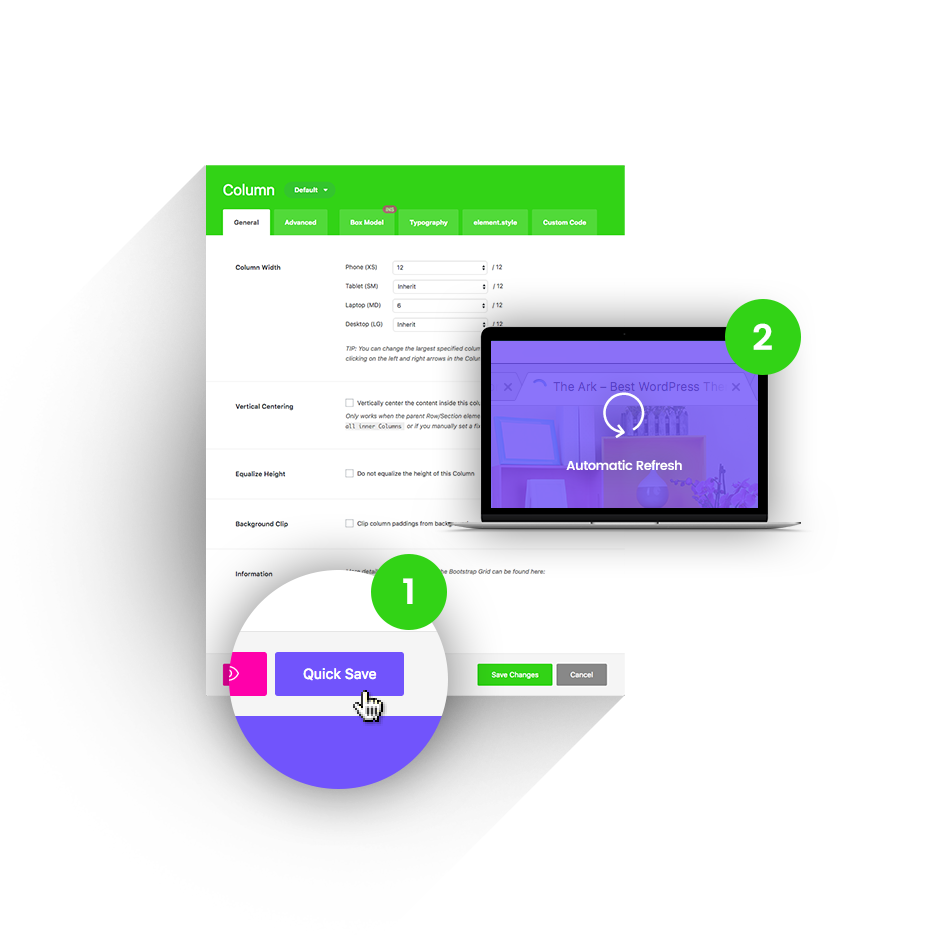

Quick Save

Other themes will reload their admin screens under your hands, making you wait up to 20 seconds to continue working. Ark will instantly save in the background (AJAX) and even update the front-end of your website.

1 Press the Quick Save button.

2 Changes refresh automatically.

Features

Everything you would expect from a top premium theme and then some.

SEO optimized

We consulted leading SEO and marketing specialists when writing our code, so you wont have to

Speed Performance

We carefully optimised Ark. GTMetrix 94, Pingdom 99 scores.

Responsive

You can set anything for every breakpoint. Including font size, text align, etc.

Multilanguage

Fully supports WPML (except for their premium automatic translations system) for making multilanguage versions of your websites.

WooCommerce

Perfect integration, great for making shopping sites

5 star support

Best rated support across whole ThemeForest

Header builder

Make any header you want to

Lifetime Updates

We iterate on weekly cycles. Also we listen to our user's suggestions.

Child Theme

Ark is delivered with Child Theme for your better comfort

Social Media Options

Enhance your website with social media options

Unlimited Sidebars

You can insert them in footer or content. Layout with 2 sidebars comes out of the box.

1 click demo import

Choose your demo, click "import" and tadaa, done.

Unique Features

Ark is always ahead. So far we have introduced 30+ unique features. For the first time in the world and exclusive to Ark.

Icon Fonts

Ark is delivered with 4000+ icons. We have fulltext search and you can upload your own icons.

Sitemap

You can customize every part of your website. For example assign different header and footer just for your blog single page.

Global Color Library

50 slots for saving colors, works like "variables". You change the color once, globally, change appears everywhere.

Keyboard Shortcuts

All accessible with 1 hand. Copy, paste, duplicate, remove, disable, enable, save, edit.

Background Layers

You can layer up different background types. Insert color, then parallax image and finish up with background activated only on hover

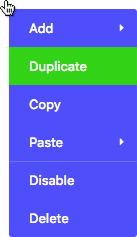

Context Menu

Right-click everywhere, just like on the desktop. Makes super-fast workflow.

220+ Builder Elements

Every element has 1500+ customization options on average. First time in history, only sky is the limit.

Dark/Light text color

Every element has CSS styles for dark / light text color. Change them with just 1 click, set advanced inheritance if needed.

Quick Save

Hit this button, your builder is saved trough AJAX and front-end is automatically refreshed in same time. No waiting! Available everywhere!

Match Height

Match height of your columns just by one-click. Can be set for every breakpoint.

Advanced Image Options

Every image can be resized, set it's quality, aspect-ratio, make it fullwidth, prevent being larger than container. Also alt and title attributes can be set easily.

Vertical Centering

Vertical centering of content is basically a taboo in CSS. We changed it! Enabled by one-click. Can be set for every breakpoint.

Fullscreen Sections

Set the height of your section as a 100% of window height and deduct -90px for your navigation menu.

Form Builder

Create amazing forms, style them, customize them and even hook the sending actions with your analytics

Visibility

Every element or it's part have 4 checkboxes. You can hide / show them for every breakpoint.

Slider Builder

Create slider, insert slides. Fill them with Fresh Builder Elements. Set autosliding. Choose between 3 slider types.

Clever Buttons

More than 10 basic variations, can be customised up to 1000+. 2 buttons in 1 row can be done pretty easily

Smart Links

Every single image has these settings, pictured on the right image

Custom Post Types

Ark plays with custom post types like a charm. No coding skills required, everything can be done in Fresh Builder

Builder in Builder

Customize every part of your element. Reorder it's pieces with drag and drop interface.

Custom Container width

Adjust your site width in Theme Options. Can be set for every breakpoint.

Loop Builder

Customize loop, post content, featured image, post meta and more. Drag and drop them to your wish. First time in history

System Tabs

Every element or it's part have 4 customizations tabs. Box Model, Typography, Element.Style and Custom Code

Complete Bootstrap

All the col, row, push, pull, offsetting and much more! Infinite nesting introduced for first time!

Support

Average response time is : 14 hours and 32 minutes

Users do not need

support at all

Users are satisfied with support

quality and response time

Tickets solved within

first response

Meet our community

Ark is their #1 theme

Of our users are making

websites for living

Of our users will make more

than 7 websites this year

Happy members

17,000+

Extra Value

$25*

$20*

$20*

$24*

$24*

$42*

$155*

*This is price for which are plugins sold separately

Included in the Ark for FREE

Ark loves integrations

Our system works perfectly with all these tools and platforms

WooCommerce

WPML

MailChimp

Advanced Custom Fields Pro (ACF)

Revolution Slider

WP Super Cache

Jetpack

Yoast SEO

Membership Pro

Ultimate Membership

Restrict Content Pro

Google Analytics

Contact Form 7

Layer Slider

Custom Post Types

Facebook Comments

Essential Grid

Coming Soon plugins

NextGen Gallery

CPT UI

and many more ...

Detailed documentation

Plus many helpful videos with English voiceover

The #1 Best Rated Topseller

See why we are #1 out of 9,500+ themes

4.97/5

"This theme is extremely flexible, and can fit just about any site you want to build."

– Jaythekreator

– Jaythekreator"The best theme I have ever used. Years ahead of Avada, years ahead of Enfold."

– Billions

– Billions"Ark theme is the one which I’ve been searching for for years!"

– Glowczynski

– Glowczynski"I haven't seen such an impressive theme for a long time... And I've seen many! What a gem!!!"

– WebScope

– WebScope"Ark is literally the best theme I've ever used and I've used more than a hundred premium themes."

– Meceware

– Meceware"Too painful to use any other theme now, after getting used to Ark."

– Khalid123456

– Khalid123456